Quickly calculate your business vehicle lease cost.

Whether you need 1 or 20 vehicles for your business, a Fully Maintained Operating Lease* by FleetPartners means there are no upfront costs and a single monthly payment that includes scheduled servicing, maintenance, replacement tyres, 24/7 roadside assistance, and more. Plus, we’ll take care of the ongoing and time-consuming vehicle administration related to accident management, fuel, tolls, as well as annual re-registration. You’ll get the vehicles you need to keep your business moving while knowing exactly what you’re spending each month, helping to keep your cashflow in check.

In less than 2 minutes, you can choose, compare and shortlist vehicles and get obligation-free business operating lease estimates#.

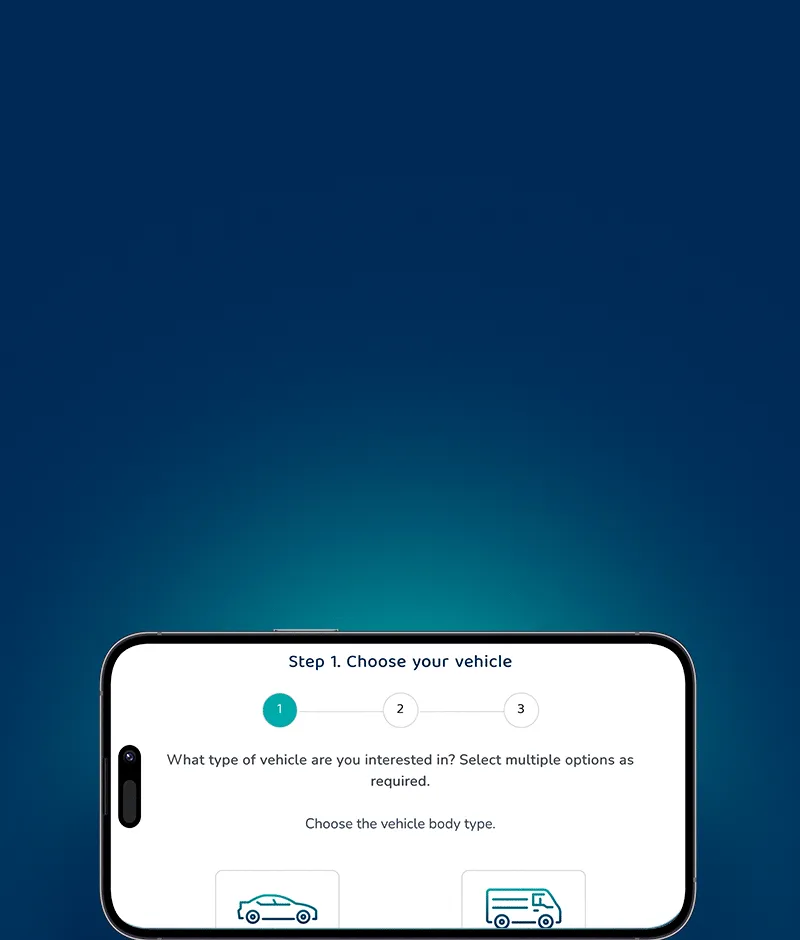

Step 1. Choose your vehicle

What type of vehicle are you interested in? Select multiple options as required.

Choose the vehicle body type.

Browse some of the most popular models

FAQs about our business vehicle leasing calculator

What is a Fully Maintained Operating Lease?

A Fully Maintained Operating Lease is like a rental agreement for a vehicle. You lease the vehicle from FleetPartners for a set term, usually between 3 to 5 years. We bundle the majority of your vehicle's running costs – including registration and CTP, servicing and tyres – into one monthly payment for the duration of your lease term.

When calculating your monthly payments, we also consider how many kilometres you drive and how long you plan on leasing the vehicle. At the end of the lease, you simply return the vehicle with no residual value or balloon payment.

What are the benefits of an Operating Lease?

The main advantage of a Fully Maintained Operating Lease is that they make it easier for businesses to manage their cash flow with no upfront costs and set monthly payments.

Plus, if you have a small fleet of vehicles, you can outsource paperwork, fuel receipt reconciliation, regular services, maintenance and registration, tolls and infringements –saving yourself hours of admin time.

How accurate is the business lease calculator?

The FleetPartners business lease calculator uses the latest information from vehicle manufacturers and maintenance and servicing providers – it then refines this to meet your search criteria, such as vehicle body and fuel type to provide you with pricing estimates.

While the calculator doesn’t provide a specific vehicle quote, the results will provide a great guide which can help you decide which vehicle suits you. Our team can then provide you with an accurate quote on the exact vehicle you’re after.

What happens once I’ve calculated my estimated repayments?

Once you’ve calculated your estimated payments for leasing a business vehicle, you can request a call back from our team. When you’re ready to go ahead, we’ll leverage our dealer network to negotiate a great price on the exact car you want.

The price of your lease can include accessories like branded car wraps* (which are great for advertising your business) or roof racks, the number of kilometres you travel on average, the lease term, and running costs like servicing, maintenance, tyres and insurance.

* Customised vehicle branding must be removed prior to returning vehicles to FleetPartners at the end of their lease term.

Which types of vehicles can be leased?

With a Fully Maintained Operating Lease for small and medium businesses, you can choose whatever vehicle suits you best, including cars, vans, SUVs and utes (up to 3.5 tonnes) in a wide range of makes and models, including electric, hybrid, petrol and diesel options.

If you need a more specialised vehicle, custom fitout or accessories or, if you’re a large corporation (enterprise customer) needing a heavy commercial vehicle solution, please call us to speak with one of our vehicle specialists.

What happens to vehicles at the end of the lease term?

As long as you’ve taken care of the vehicle and the wear and tear is fair, and your kilometres driven in line with the lease agreement, you simply return the vehicle. In some cases, you can also extend the lease term or we can provide you with a quote to replace it with a brand-new vehicle of your choice.

Ready to lease a business vehicle?

Contact us or explore our calculator today.

* Applicants must have a valid ABN, been GST registered for at least 2 years and have business turnover greater than $125,000 per year. All applications are subject to credit approval criteria. Terms and conditions, fees and charges apply.

# The Business Leasing Calculator (the “Calculator”) is provided for illustrative purposes only and the results are intended to be used as a guide only. It does not constitute a quote or an offer to enter into, or an agreement to provide an operating lease.

* Figures are based on the following criteria: 1) FleetPartners Fully Maintained Operating Lease; 2) NSW on road costs; 3) 75,000 kilometre limit over the life of the lease; 4) 60-month lease term; 5) Vehicle delivered to a metropolitan area in your capital city; 6) Payments made monthly in arrears; 7) Budgeted running costs inclusive of vehicle finance, stamp duty, on road costs, fuel management, 4 replacement tyres, scheduled servicing and maintenance, re-registration over the period of the lease, 24-hour roadside assistance, accident management services, toll and infringement management. Vehicle pricing is correct at the time of publishing but may be subject to change based on availability. Vehicles must be ordered before 31/12/25 (unless extended) via the FleetPartners preferred dealer network. The Fully Maintained Operating lease offers are only an indicative approximation and availability on the selected new vehicles and models shown and may change at the time the lease quotation is completed and finalised. Offers not available in Tasmania and the Northern Territory. Options, accessories and changes to the lease term or kilometres may change the quoted lease payment. Vehicle delivery timeframes may vary, depending on manufacturer availability. You must return the vehicle at the end of the lease term. Fair wear and tear and excess kilometre charges may apply. Applicants must have a valid ABN, GST registered for at least 2 years and a business turnover greater than $125,000 per year. All applications are subject to credit approval criteria. Terms and conditions, fees and charges apply.